The freight market has totally lost its cycle predictability. Instead of the traditional pattern of gradual highs and lows, the players in the freight industry including carriers, dispatchers, and drivers are now experiencing drastic changes caused by spot rate variations, contract resets, fuel volatility, regulatory pressure, and demand imbalance. In these conditions, conventional planning models are apt to deteriorate in a matter of days. The models, the very same that were effective even two or three years ago, have lost their efficiency now.

Restructuring planning in a freight market characterized by high volatility is no longer a competitive strategy, but rather, a necessity for survival. For both trucking companies and truck drivers, the common denominator in now stable life is the level of fluidity planning systems have in adapting them to the uncertainty instead of making efforts to cancel it.

In this article, we discuss how freight market planning should evolve, the necessary changes in logistics and transportation planning, and how to develop resilience alongside operational control.

How Traditional Freight Planning Does Not Perform in a Volatile Market

Historical logistics planning capitalized on the immutable basics: predictable demand, regular lanes, and manageable cost structures. When the market is volatile, these conditions become all the more unrealistic.

Some typical weaknesses include:

- High dependency on fixed routes that detach profitability overnight

- Long-term capacity commitments that don’t listen to the market cuts

- Reactive dispatching instead of transportation planning

- Delayed response to rate drops and demand shifts

When market volatility grows, static plans become like almighties for winning. Contemporary planning is not about accuracy, but rather about adaptability.

Learning About Volatility with Freight Market Analysis

Before reconnaissance restructuring companies need to identify the type of volatility they are experiencing. Not all disruptions have the same effect.In a volatile environment, a freight market forecast no longer serves as a prediction tool, but rather as a framework for identifying risk zones, probability ranges, and early warning signals for planning decisions.

Practical freight market analysis is oriented towards:

- Spot vs contract rate divergence

- Lane-level demand changes

- Seasonal vs structural demand shifts

- Regional imbalances in transport capacity

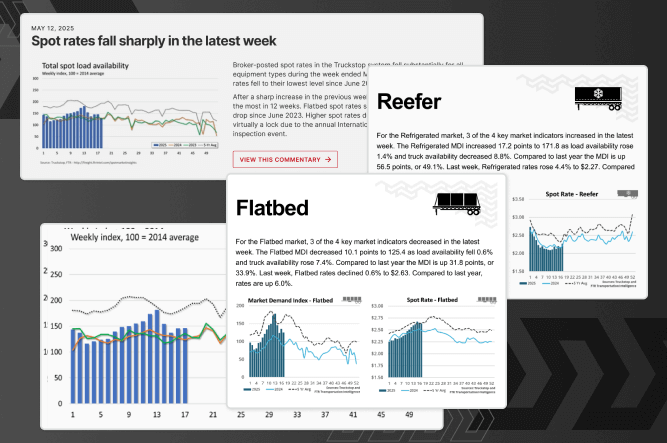

According to the 2026 truckload freight market outlook from C.H. Robinson, spot rate forecasts were revised higher and freight volumes remain volatile, with year-over-year growth expected but continuing uncertainty in demand and capacity dynamics.

With cycling short data rather than annual averages planners can act accordingly rather than wait until the market goes down. This cutting also serves as the basis of the supply chain reshaping — no could-be-overhead type forecasting.

1359. #TFCP – Freight Market Reality: Capacity, Rates, and Spot Market Tips!

Converting From Static Plans to Flexible Logistics Strategy

An actual and state-of-the-art logistics strategy that is designed for high volatility is built on flexibility over queue optimization.

Strategy responses involve:

- Shifting from fixed schedules to rolling planning windows

- Layering freight by volatility degree (stable, semi-volatile, and high-risk)

- Core lanes are segregated from opportunistic freight

- Shipping planning should be conducted in concert with real-time cost thresholds

This method minimizes decision-making time and cuts down on exposure to such things as sudden market shifts.

Supply Chain Restructuring for Freight Volatility

The most sought-after resilience force is to empower supply chain restructuring not just through upper body adjustments. Planning will entail radials of sequential and prime impacts.

Key restructuring focuses will be:

- Helping a load download from a single shipper or broker

- Sourcing freight from different regions

- Setting contract freight levels and spot exposure as a percentage of total freight

- Adding redundancy in shipping logistics

The overall picture of these efforts together is the creation of a supply chain synapse that no matter how tricky parts of the market could be, the core is always functional and indisturbable.

Capacity Planning and Demand Forecasting Under Uncertainty

In chaotic conditions, demand forecasting pivots from precision to probability. The primary performance measure, however, is not writing down the correct figures but knowing the probable ranges and associated risks.

Ordinary capacity planning should:

- Use short-term forecasts instead of long-range commands

- Retain buffer capacity for high-variance lanes

- Tune driver schedules dynamically

- Invulnerate core driver income while keeping idle time at bay

For instance, truck drivers are sometimes affected directly because when a carrier does not have enough miles, drivers may go home more frequently and bring unpredictability in terms of income.

Trucking in 2025 Sucked. Will 2026 See a Recovery?

Cost Optimization Without Over-Cutting

When it comes to burdens, cost cutting is not the solution always. Smart cost optimization is about engaging flexibility rather than directly cutting.

Means and strategies involve:

- Different cost structures and commitment models

- Fuel strategies that aligned with route volatility

- Maintenance planning linked utilization rather than calendar time

- Selective acceptance of freight based on margin thresholds

This supports risk management without undermining operational readiness.

Transportation Planning from the Driver’s Perspective

Planning transcends management practice; it also has vital implications for the drivers [fleet]. Insufficient transport planning creates unpaid downtime, erratic schedules, and burnout.

Driver-centered planning should:

- Prioritize predictable lanes where possible

- Limit exposure to high-uncertainty freight

- Align dispatch decisions with Hours of Service realities

- Communicate planning changes clearly and early

Stable planning improves driver retention and operational reliability in volatile markets.

Risk Management as a Core Planning Function in Volatile Freight

In a volatile freight market, risk management can no longer be treated as a second or a financial-only function. It must be embedded directly into daily freight market planning and dispatch logic.

Effective risk management in trucking begins with identifying where there is no net gain from volatility. But this is usually not just through the rate compression of core lanes, prolonged driver downtime, mismatched fuel costs, or unable to be pulled quickly, rigid capacity commitments.

A structured approach can be multiplying freight by not just the average risk but by the profile that goes with it. Freight with a higher margin but an unstably changing demand can turn out to be riskier than a contract with a lower margin but a steady flow. The planning teams will need to consider the likelihood of a lane going downhill, the rigidity of the trucks in being repositioned, and the extra time unpaid that the drivers would be taking if the freight is taken away.

Navigating a Turbulent Freight Market

To a driver, the impact of bad risk planning is visible through inconsistent miles, last-minute reshuffles, and being forced to wait. The planning approach is not about removing uncertainty. Instead, it is about defining the operational boundaries that make it bearable.

Freight Risk Categories in Planning

| Risk Category | Characteristics | Planning Response |

| Low Risk | Contract freight, stable lanes | Long-term scheduling |

| Medium Risk | Seasonal or regional volatility | Rolling planning windows |

| High Risk | Spot-only, rate-sensitive freight | Strict acceptance thresholds |

| Critical Risk | Single-shipper dependency | Diversification or exit |

Operational Planning Metrics That Matter in Unstable Markets

In a volatile context, the improper metrics mislead you into a false sense of security. The most planning systems are still anchored on averages that misstate volatility rather than clarify it.

A key metric is time to capacity redeploy, which is the speed that trucks can move to different lanes. Deadhead distances, rigid appointment windows, or limited regional coverage all increase exposure.

The other key factor is the stability of revenue per driver not just mile. A high CPM does not mean much if miles do not add up. The planning must measure how well the work is balanced with income interruptions.

Moreover, cost visibility is a must as well and needs a change. Planning should no longer focus on total cost but rather the cost sensitivity under the condition of decreased utilization or increased volatility.

Furthermore, decision latency is a concealed risk. Quick and cohesive planning updates are more valuable than the provision of optimally perfect but slow decisions.

Traditional vs Volatility-Oriented Planning Metrics

| Metric Type | Traditional Focus | Volatile Market Focus |

| Revenue | Average CPM | Revenue consistency |

| Capacity | Utilization rate | Redeployment speed |

| Costs | Total cost | Cost sensitivity |

| Planning | Monthly cycles | Rolling weekly updates |

| Drivers | Miles driven | Income stability |

Building a Volatile Market Strategy That Holds

A sustainable volatile market strategy combines data, flexibility, and discipline. It does not chase every rate spike, nor does it freeze during downturns.

Strong strategic planning in trucking includes:

- Clear decision rules for accepting or rejecting freight

- Defined thresholds for redeploying capacity

- Regular review of market uncertainties

- Continuous market restructure based on performance feedback

This planning strategy allows companies and drivers to stay profitable without relying on perfect conditions.

Final Thoughts: Planning Is the New Competitive Advantage

In the present day’s freight environment, volatility would be eternal. The companies that will go on existing are not those that do the best forecasts, but those that do the best planning.

By reshuffling freight market planning logistics, supply chain resilience, and ensuring transportation planning stays reactive only to the real-world uncertainties, trucking operations can be stable even if the market is not.

In a volatile freight market, planning has transformed from a mere issue of control to the one of staying operational amid standard shifts that break off everything.

FAQ: Planning in the Volatile Freight Market

How do current market freight rates influence decision-making?

As stated by the latest freight market trends, volatility is no more periodic but rather systemic. Carriers now have to deal with the conflicts of rapidly swinging spot rates, unnoticed geographic disparities, and quicker-than-expected contract renegotiations. Therefore they are now pushed to shorten operational planning cycles. Planning should not depend on annual or quarterly expectations but instead be consistently realigned based only on short-term signals. Delayed planning, parked trucks, and inactive driver utilization performance are consequences for the companies that do not take these strategies into account.

To what extent does shipping goods planning have difficulty adjusting during market fluctuations?

Compared to just-in-time systems, traditional freight planning concentrates on the constant flow of goods through fixed lanes, stable volumes, and known costs. However, when market fluctuations occur, these assumptions no longer stand. Market rates can fluctuate faster than trucks can be scheduled, while freight volume may drop without notice. Without flexible planning windows and cost thresholds, shipper collaborations become obsolete, leading to inefficient dispatching, excessive deadhead, and unpaid driver downtime.

How can freight market predictions still generate value in an unstable environment?

The freight market outlook confirms that the predictive role of shipping has altered. Instead of forecasting high rates or heavy volumes, forecasts now focus on risk zones, probability ranges, and early warning indicators. Modern planning uses these insights to adjust capacity, pricing, and routing before losses accumulate.

How should carriers use planning to cope with continuous rate fluctuations?

To manage ongoing market changes, freight carriers should embed flexibility into planning systems. Rolling planning horizons, separating stable freight from high-risk loads, and defining clear redeployment rules allow trucks, drivers, and costs to be repositioned quickly. Speed of adjustment should replace the pursuit of perfect optimization.

What is the biggest planning mistake companies make in volatile markets?

The most widespread mistake is treating volatility as temporary. Many firms expect normalization and delay restructuring. However, volatility has become the norm. Legacy planning systems lack the foresight to adapt repeatedly, leading to unreliable driver income and long-term strategic erosion.

How does enhanced planning improve driver stability during difficult periods?

Better planning reduces uncertainty for drivers. Fewer last-minute changes, more predictable miles, and reduced unpaid waiting time improve income stability. Planning that accounts for volatility supports driver retention even as market conditions shift.