Choosing between a big carrier with small fleet has always been one of the biggest decisions in a truck driver’s career. At this moment, this decision was usually seen as a clash of type of person and living preferences. Shifting the question towards something more essential, drivers of today want to talk about trucking career stability more than anything else.

Drivers’ queries have changed yet it is still a drainage on them to earn profit during tough freight cycles, compliance burdens, and bills increases. Drivers start thinking not only about their paycheck for the forthcoming month but also about their work hereafter. They ask existential questions about their jobs. As such, understanding how the size of the carrier can affect employment security issues, income prediction, and long-term benefits has become of utmost importance.

The present article is carrier vs fleet comparison based on risk, long-term employment, and stability; not marketing promises.

Trucking Industry Ratios

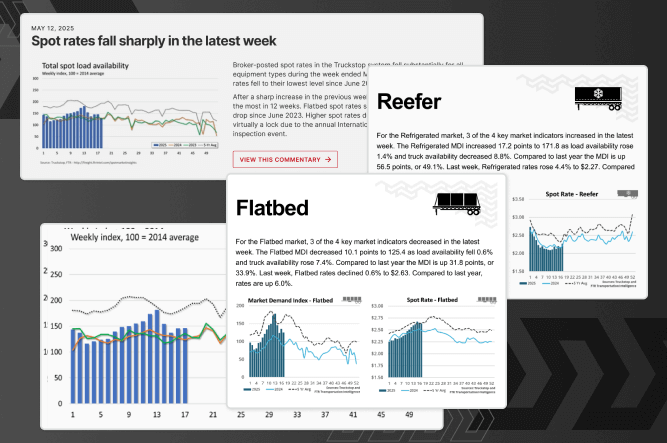

Given that the next decade of the trucking industry would exhibit moderate, rather than steady, growth, one can argue that the trucking industry outlook remains uneven and highly dependent on market structure rather than demand alone. Freight volumes are less volatile, contract rates are more stable, and the risk is less than average.

Drivers in the freight transport industry can expect the following freight market trends:

- Less larger shippers are consolidating freight with fewer carriers

- Higher compliance and insurance costs are an issue

- Technology investments are with the big guys

- There is still a high driver turnover in the market

Being a commercial driver means, in the first place, a dependability issue which is not solely connected with the professional skill of driving. It more closely relates to whether the carrier itself has the ability to bounce back from adversities.

Big Carriers: Needing No Cues

The ten largest truck companies are achieving results by employing the scale, the diversification models, and the institutional power. These biggest trucking companies demonstrate clear large trucking company benefits when it comes to long-term operational resilience. This is a reality and it is a big fleet advantage for drivers who want stability in the long term.

The main advantages are:

- Long-term contracts with specific freight shippers which can minimize the cyclical nature of freight

- Dedicated and regional routes that the spot market cannot touch

- Compliant, safe, and legal departments that are strong

- Payroll structures, and benefits that are predictable

These factors represent some of the most consistent big fleet advantages in unstable market conditions.

Carriers distribute short-term driving conditions best as losses are shed over miles of a fleet then just a few, which strengthens overall fleet stability analysis.

Trucking for a LARGE CARRIER VS SMALL CARRIER (Advantages, Disadvantages, Pros and Cons)

Progression of Career at Big Fleets

One more advantage is career growth in the transportation industry. Large carriers have diverse internal paths that support long-term career progression trucking:

- Transition from OTR to dedicated or regional

- Trainer, mentor, or safety roles

- Yard, dispatch, or management transitions

For drivers who are concerned about long-term trucking employment, this internal mobility matter a great deal. It minimizes the risk of being kicked out from the industry because the physical state is not as required anymore.

Small Fleets: Redefining Flexible and Risky

The True Risks Involved With Small Companies

Small trucking companies frequently appeal their employees with the statement of flexibility, personal relationships, and higher pay in the short run. However, this is only part of an argument, since some drivers come across with the small trucking company risks that are usually not realized.

- Some of the small fleets’ disadvantages are:

- Increased dependence on spot market rates

- Little financial buffer during downturns

- Lesser lanes and clients

Higher risk to insurance, fuel, and repair cost spikes

These issues highlight common small trucking company risks related to concentration and cash flow.

In many cases, the profit margin is directly related to the flow of the owner’s cash. If the owner’s cash flow is not good, a fleet could be shorter by the amount of trucks.

WHICH IS BETTER, WORKING FOR A SMALL TRUCKING COMPANY OR A LARGE TRUCKING COMPANY?!

Owner-Operator vs Fleet Factors

In veering toward a new owner-operator vs fleet dynamic, small fleets typically have their similarities to operating systems of owner-operators rather than bearing true freight carrier structures. Therefore:

- Income volatility is higher

- Downtime impacts payroll directly

- Freight access depends on personal relationships

It is rewarding during the boom period, but during the bank periods, it is loose.

Carriers of Different Sizes: It Is a Matter of Security or Control

A direct carrier size comparison clarifies that stability, and control often lie on the different sides of the spectrum.

| Factor | Big Carrier | Small Fleet |

| Job security transportation | High | Variable |

| Freight access | Contract-based | Often spot-driven |

| Pay consistency | Stable | Fluctuating |

| Flexibility | Limited | High |

| Risk exposure | Shared | Concentrated |

Drivers are to choose between the right of self-determination and security (if any).

What Freight Market Volatility Means for Drivers

Often overlooked in the small fleet vs large carriers discussion is the way changes in freight markets impact on a driver’s daily stability. Often, discussions are on salary rates and time spent at home yet freight distribution tools are way more important in the perspective of a long time.

Diverse freight be involved in big carriers because dedicated accounts, contract freight, and regional distribution networks, alongside one another, enable them to retake capacity once one segment gives way. Steady miles mean fewer unpaid layovers which means stable trucking jobs in practice.

Small fleets meanwhile are, frequently, dependent on spot markets, especially, those customers which tend to be unreliable. If the market is bearish then the impact is totally immediate. Sitting trucks, unplaced miles, and lesser pay at all. In a fleet stability analysis, unhedged concentration is number one in this case even for an experienced or skilful driver.

Long-Term Career Planning: Stability Wins The Race

A lot of drivers approach the trucking business with a short-term look: earn as much as possible now and consider the future later. Conversely, this logic often absorbing thoughts of transitions truck driving enough to lead drivers into a burnout, or gaining forced or unplanned exits from the industry.

Big carriers champion clearer, transport career paths as their structure allows drivers to advance in age with the system. Drivers, as time passes and their physical condition is changing, can move from the role of OTR to regional, dedicated or move to no-driving role. This internal mobility strengthens the security of the commercial driver.

The owner operator-vs-fleet dynamic also plays a role here, as small fleets expose drivers to business risk without business control.

Truck Driving Jobs Future: Where’s The Security?

The truck driving jobs future reveals numerous insights:

- Large fleets are likelier to act in accordance with upcoming regulations

- Carriers that innovate and telematics benefit from automation

- Shipper sites lurk to firm relationships rather than flexibility

- Insurance presents small operators with penalized markets quicker

This makes it increasingly probable to find stable trucking jobs in more structured, contract-driven surroundings.

Final Evaluation: Where Is The Career More Stable?

In the light of the job security transport perspective, big carriers have always been able to supply their people with more solid solutions against the market shocks, legislative changes, and economic downturns.

Drivers who focus on commercial driving stability, reliable earnings, and career longevity should opt for big carriers for the coming years.

In trucking, independence is a blessing — but stability is the one that supports life.

FAQ: Big Carrier vs. Small Fleet — Career Stability In Detail

Is it safe to assume that long-term trucking employment is best with a big carrier?

Not automatically, but under most sector conditions, large caries offer a better trucking career stability for employees. Their many types of freight, their contract-based customers, and their money in the bank are all reasons that help to protect drivers in downturns. This means that the chance of sudden cuts, parked trucks, or unpaid downtime is lower, which directly strengthens commercial driver security in the long run.

Are small fleets really more dangerous for drivers?

Yes, small trucking company risks arise from the structure itself. Usually, smaller fleets are dependent on spot market freight and a small number of customers. Such a situation in the freight market leads to situational rise in income instability very quickly. For drivers, it means the number of miles will decrease, the schedule will backfire, and drivers will have to deal with layoffs more often when cash flow gets tighter. These patterns represent typical small fleet drawbacks during weak market cycles.

In what way does the size of the carrier influence career progress in truck driving?

Carrier size is a key factor in determining the hurdles faced by the driver in the road of career progression trucking. Large carriers predominantly provide the possibility of internal mobility, which might include, for example, moving drivers from OTR to regional, dedicated, training, or even to other careers not involving driving. In contrast, small fleets usually do not have such a structure, which results in harder long-term career shifts in the case of changes in physical or lifestyle needs.

Is an owner-operator like working for a small fleet?

In most occasions, yes. The owner-operator vs fleet dynamic indicates that small companies resemble what owner-operators would have to face. Fuel was very low, and with no runs throughout the week, the drivers surely suffered. Such years result in unpaid downtime, stories of unavailable freight, and refinancing debts, without strong financial control of the operations.

Which way transit jobs are more resistant to market downturns?

For a long time now, the stable job in trucking has been with a big carrier. They are in a position to share their losses across the entire fleet, unlike small carriers who end up having all the losses at once. From the standpoint of fleet stability, diversification is more critical than short-term pay bonuses.

To what extent do freight market fluctuations affect truckers’ job security?

At the moment, freight market conditions predominantly benefit carriers with long-term contracts and large-scale operations. As shippers place greater importance on dependability and legality, big carriers are the real winners though. So the drivers of the companies that go with the trends benefit from fewer disturbances and more predictable income.

What are the upcoming changes in the trucking industry that will affect driver stability?

The overall trucking industry continues to evolve through technological developments, consolidation processes, and stricter compliance obligations. These shifts tend to benefit larger carriers with stable structures. Even though small fleets will keep existing, their business model will remain more sensitive to market shocks and cyclical downturns.

Should drivers pick flexibility over stability?

It is a personal decision. Drivers who feel the need for independence and quick cash may choose small fleets. However, those who are looking for a long-term income forecast, benefits, and a stable career can benefit more from the big fleet advantages offered by larger carriers.

The freedom that trucking brings gives a feeling of power — but stability is what truly keeps careers alive.